BRD Acțiuni

Class RON and Class EUR

Open investment fund that invests mainly in shares of Romania, up to 90% and 10% other assets with high liquidity such as: deposits, fixed income instruments, as well as financial instruments allowed by the legislation in force.

It aims to achieve relatively high financial performance while maintaining the investment over a longer time horizon.

The performance of the Fund may be influenced by the negative performance of one or more financial markets in which the Fund invests. In this sense, there is no form of guarantee for the investments made by investors.

Who does it suit?

You can choose this fund if you want to invest long-term in the Romanian stock market. If you have liquidity in RON or euro, and you want a diversified portfolio of shares of companies listed mainly in Romania, then this fund may be right for you. Given the fund's profile, it is suitable if you have a long-term investment horizon and are willing to accept a high degree of risk.

ISIN Fond Class RON: ROFDIN000168

ISIN Fond Class EUR: ROFDIN0002I6

Decizie autorizare ASF: nr. 1714/27.08.2008

Registru ASF: CSC06FDIR/400057/27.08.2008

GIIN: YCEN9M.00005.SF.642

LEI: 5493008ATEVGCBO84K67

Urmărește evoluția Class RON pe Bloomberg*

Urmărește evoluția Class EUR pe Bloomberg*

* Informațiile sunt prelucrate și puse la dispoziție de entitatea-terță Bloomberg, iar BRD Asset Management S.A.I. S.A. nu iși asumă nicio responsabilitate cu privire la conținutul informațiilor furnizate de Bloomberg.

Informațiile și datele prezentate au rolul de a permite clienților și potențialilor clienți ai BRD Asset Management S.A.I. S.A. să ia o decizie de investiții informată. Prin consultarea acestui material, sunteti de acord sa accesați și utilizați aceste date exclusiv în scop investițional.

mediu spre scăzut (Class EUR)

History

Monthly Newsletter - 31.01.2026

Documents

Sustainability-related disclosures

Sustainability Information

Product name: Open-End Investment Fund BRD Actiuni

Classification under EU Regulation No. 2088/2019: Article 8

LEI: 5493008ATEVGCBO84K67

Version 1

Date:13.10.2025

Information regarding the Open-End Investment Fund BRD Actiuni which promotes environmental and social characteristics

The Open-End Investment Fund BRD Actiuni (FDI BRD Actiuni) is a financial product investing primarily in the Romanian equity market. The investment fund promotes environmental and social characteristics by constructing a portfolio of equities that have improved environmental, social, and governance (ESG) characteristics at the aggregate portfolio level. However, the fund does not have a sustainable investment objective nor aims to have a minimum proportion of sustainable investments. The fund will invest at least 75% in financial instruments aligned with environmental and social characteristics. ESG analysis will complement the established evaluation of financial information to support investment decisions. For selecting financial instruments (equities, bonds, UCITS ETFs, and money market instruments), the fund will use specific ESG methods such as positive screening or exclusionary screening and ESG scores from a reputable external data provider (Morningstar - Sustainalytics) to build a portfolio with improved environmental, social, and governance characteristics, aiming to contribute to reducing environmental and social risks.

This financial product promotes environmental or social characteristics but does not have sustainable investments as its objective nor aims to have a minimum proportion of sustainable investments.

The Open-End Investment Fund BRD Actiuni aims to contribute to reducing environmental and social risks by constructing a portfolio primarily exposed to the Romanian equity market, with improved environmental, social, and governance (ESG) characteristics at the aggregate portfolio level. The fund will invest at least 75% in financial instruments aligned with environmental and social characteristics.

To promote environmental and social characteristics by building a portfolio with improved ESG characteristics, the fund will use specific ESG methods:

- Use ESG scores from a reputable external data provider (Morningstar - Sustainalytics).

- >Positive screening or exclusionary screening. In cases of investments in financial instruments with similar characteristics (such as industry, sector or geographical exposure, type, liquidity, costs, etc.), the fund will select instruments with superior ESG scores. The fund will not invest in financial instruments with an ESG score above 50 according to Morningstar – Sustainalytics;

- Monitoring the overall ESG risk of the fund and limiting it by maintaining an aggregate average score of financial instruments with improved environmental and social characteristics (equities, bonds, ETFs, and money market instruments) of maximum 25. If the aggregate average score of these instruments exceeds 25, the fund portfolio will be rebalanced within a reasonable timeframe and respecting investors’ interests.

The Open-End Investment Fund BRD Actiuni invests primarily in the Romanian equity market. The fund will maintain an adequate liquidity level, considering the risk involved in equity investments and the liquidity of the portfolio assets, under the conditions and limits mentioned in the prospectus and in compliance with applicable regulations. The investment policy aims to diversify the portfolio by acquiring equities to reduce the risk assumed by the fund through risk dispersion across multiple financial instruments and industries. ESG analysis will complement traditional financial evaluation to support investment decisions. For selecting financial instruments (equities, bonds, UCITS, and money market instruments), positive and exclusionary screening will be used to build a portfolio with improved ESG characteristics to reduce ESG risks.

To evaluate good governance practices of invested companies, including solid management structures, employee relations, staff remuneration, and tax compliance, FDI BRD Actiuni uses an internal methodology based on the Governance (G) component of ESG ratings from Morningstar - Sustainalytics, Bloomberg data, Societe Generale’s sector policies, and company reports. Sustainalytics’ governance analysis considers company structures, practices, behaviors, and their ability to create long-term value for shareholders and stakeholders transparently. Specifically, it considers management quality and integrity, governance structures, ownership and shareholder rights, remuneration, audit and financial reporting, and stakeholder relations. Bloomberg’s governance evaluation is based on management structure, personnel issues, remuneration policy, and quality of financial reporting.

In case of ETFs, FDI BRD Actiuni will invest only in ETFs that qualify as financial products under Articles 8 and 9 of EU Regulation 2019/2088, which are required to assess the good governance of the companies they invest in. If a breach of these criteria is found after acquisition, the respective financial instrument will be sold, ensuring protection of unit holders’ interests.

The fund’s strategic (long-term) allocation by asset classes is 90% equities or ETFs investing predominantly in equities and 10% other assets such as deposits, fixed income instruments, and other financial instruments permitted by law. Equity exposure will be mainly direct exposure to entities through individual equities but may also be indirect via ETFs.

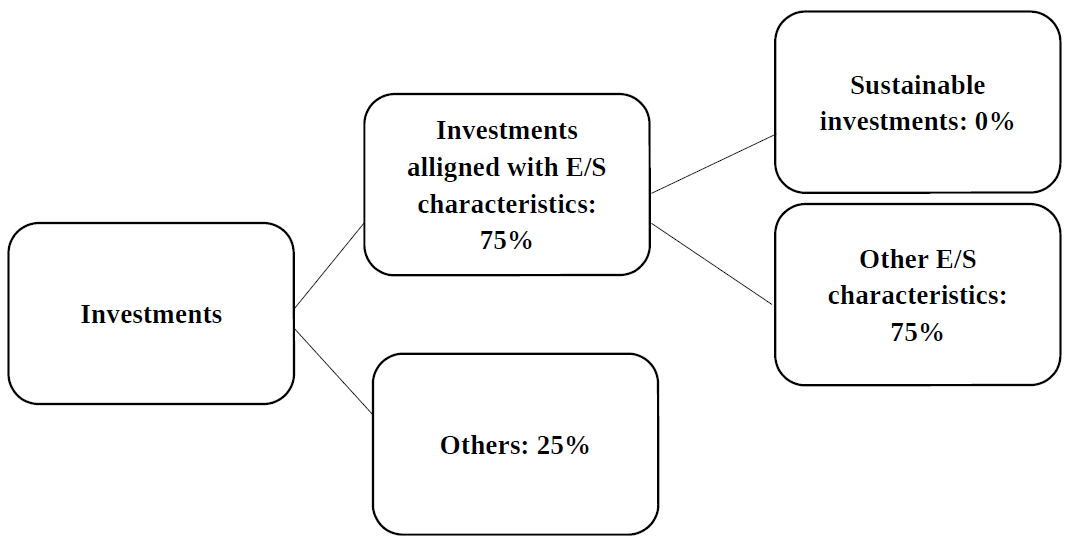

The fund will always maintain 75% of its assets in "Investments aligned with environmental and social (E/S) characteristics" ("Other environmental and social (E/S) characteristics"). This category may include equities, bonds, ETFs, and money market instruments. The "Others" category, representing a maximum of 25% of the fund’s total assets, may include financial instruments without an ESG score such as cash, equities, bonds, ETFs, money market instruments, or other legally permitted financial instruments.

To monitor compliance with environmental and social characteristics, the weighted average ESG rating of FDI BRD Actiuni holdings (equities, bonds, ETFs, and money market instruments) classified in the portfolio section with improved environmental and social characteristics (minimum 75% of total assets) must not exceed 25. The aggregate average score of financial instruments with improved environmental and social characteristics is continuously monitored, and if it rises above 25, the fund portfolio will be rebalanced within a reasonable timeframe and respecting investors’ interests.

The fund will not be exposed to financial instruments with an ESG score above 50 according to Sustainalytics. Also, the fund will hold at any time financial instruments from a maximum of 5 issuers with an ESG score above 30. ESG scores of financial instruments are verified before investment and periodically during holding.

Measurement of how the social and environmental characteristics promoted by FDI BRD Actiuni are met is based on ESG scores provided by a third-party provider, Morningstar, which provides Sustainalytics ESG ratings. Sustainalytics’ ESG risk ratings measure a company’s exposure to industry-specific intrinsic ESG risks and how well the company manages these risks. This multi-dimensional ESG risk measurement combines management and exposure concepts to provide an absolute ESG risk assessment. Sustainalytics identifies five categories of ESG risk severity that may affect a company's rating.

| Negligible | Low | Medium | High | Severe |

| 0-10 | 10-20 | 20-30 | 30-40 | 40+ |

ESG Risk Rating Scale:

Sustainalytics’ ESG risk rating methodology1 includes:

- Total exposure: Initially determines exposure to each material ESG sector.

- Manageable risk: Analyzes what part of company risk can be effectively managed through ESG programs and policies.

- Unmanageable risk: Some risks are considered unmanageable. For example, an oil company cannot fully eliminate carbon emissions risks, so these are excluded.

- Managed risk: For manageable risk, company’s performance is reflected in its policies, programs, practices, and quantitative performance measures.

- Management gap: Reflects unmanaged risk. Controversies reduce management score as they show deficiencies in company programs and policies.

- Unmanaged risk: Overall ESG risk is calculated by adding unmanaged risk values for each significant ESG aspect.

1 Details regarding the methodology used by Sustainalytics can be found here: https://www.sustainalytics.com/esg-data

FDI BRD Actiuni uses ESG scores from a third-party provider (Morningstar, providing Sustainalytics ratings) to build a portfolio with improved ESG characteristics. The Sustainalytics methodology is described above. Additionally, BRD Asset Management S.A.I. S.A. uses an internal methodology based on the Governance (G) component of Sustainalytics ESG ratings, Bloomberg data, Societe Generale sector policies, and company reports to assess good governance.

Data quality is ensured by using reputable sources (ESG scores calculated by Sustainalytics are taken from Morningstar or the Bucharest Stock Exchange). ESG scores provided by Morningstar, Bloomberg governance data, Societe Generale sector policies, and company reports are periodically verified for updates and monitoring.

ESG evaluations used for monitoring ESG characteristics and risks of the fund are obtained via a platform provided by Morningstar or the BVB. Based on Sustainalytics ESG ratings, the weighted average ESG score of financial instruments with improved environmental and social characteristics (equities, bonds, UCITS, and money market instruments) representing at least 75% of total fund assets is calculated. The effective exposure of these instruments in the portfolio is rescaled to 100%. The weighted average score is calculated as the weighted arithmetic mean of the holdings' scores in the portfolio section with improved environmental and social characteristics. The management company does not estimate ESG ratings.

Since ESG is a relatively new field, ESG analysis inherently presents challenges: company-level data may be incomplete, unstandardized, inaccurate, or temporarily unavailable; different rating providers use different methodologies, leading to varying ESG risk assessments.

ESG scores are updated periodically but may lag in reflecting risks due to complexity.

These limitations are inherent to the ESG domain due to the complexity of covered risks and the relatively recent integration of ESG in investment processes. FDI BRD Actiuni promotes environmental and social characteristics generally, intending to contribute to reducing sustainability risks nationally. Given the fund’s diversification and use of a reputable ESG rating provider covering a wide range of ESG aspects with periodic updates, these limitations should not significantly affect the fund’s ability to meet environmental and social characteristics.

BRD Asset Management S.A.I. S.A. has implemented internal governance controls to ensure obligations are met. Holdings classified in the portfolio section with improved environmental and social characteristics (minimum 75% of total assets) are periodically reviewed to limit the fund’s ESG risks by verifying: (i) ESG scores of financial instruments with improved environmental and social characteristics (equities, bonds, ETFs, and money market instruments) do not exceed 50 according to Sustainalytics; otherwise, the non-compliant instrument will be divested within a reasonable timeframe respecting investors’ interests; (ii) maintaining a maximum of 5 issuers with ESG scores above 30, otherwise divesting one of these instruments within a reasonable timeframe respecting investors’ interests; (iii) aggregate average ESG score of instruments with improved environmental and social characteristics does not exceed 25; otherwise, the fund portfolio will be rebalanced within a reasonable timeframe respecting investors’ interests. The company includes procedures dedicated to assessing relevant financial and sustainability risks in its processes.

For FDI BRD Actiuni, engagement is not part of the environmental or social investment strategy. However, the fund will support initiatives that contribute to improving environmental, social, or governance characteristics of issuers in which it invests. The fund will vote against initiatives that could increase environmental, social, or governance risks of issuers and against initiatives contradicting internationally recognized ESG principles (e.g., United Nations Global Compact).

FDI BRD Actiuni does not have a specific index designated as a reference benchmark to determine whether the financial product is aligned with environmental and/or social characteristics.

Information on how the fund promotes environmental or social characteristics is included in the Annex of the FDI BRD Actiuni Issuance Prospectus.

Information on how environmental or social characteristics have been met and on the overall sustainability impact of FDI BRD Actiuni can be found in the fund’s annual report.

Archive

Key Information Document V1 29.12.2022 - 26.04.2023

Key Information Document V2 27.04.2023 - 04.07.2023

Key Information Document V3 04.07.2023 - 26.02.2024

Key Information Document V4 27.02.2024 - 27.04.2024

Key Information Document V5 29.04.2024 - 18.03.2025

Key Information Document V6 19.03.2025 - 25.06.2025

Mai mult

BRD Acțiuni

Open end Fund investing primarily in stocks but also in monetary instruments. Is seeking for relative high financial…