BRD Orizont 2045

Class RON and Class EUR

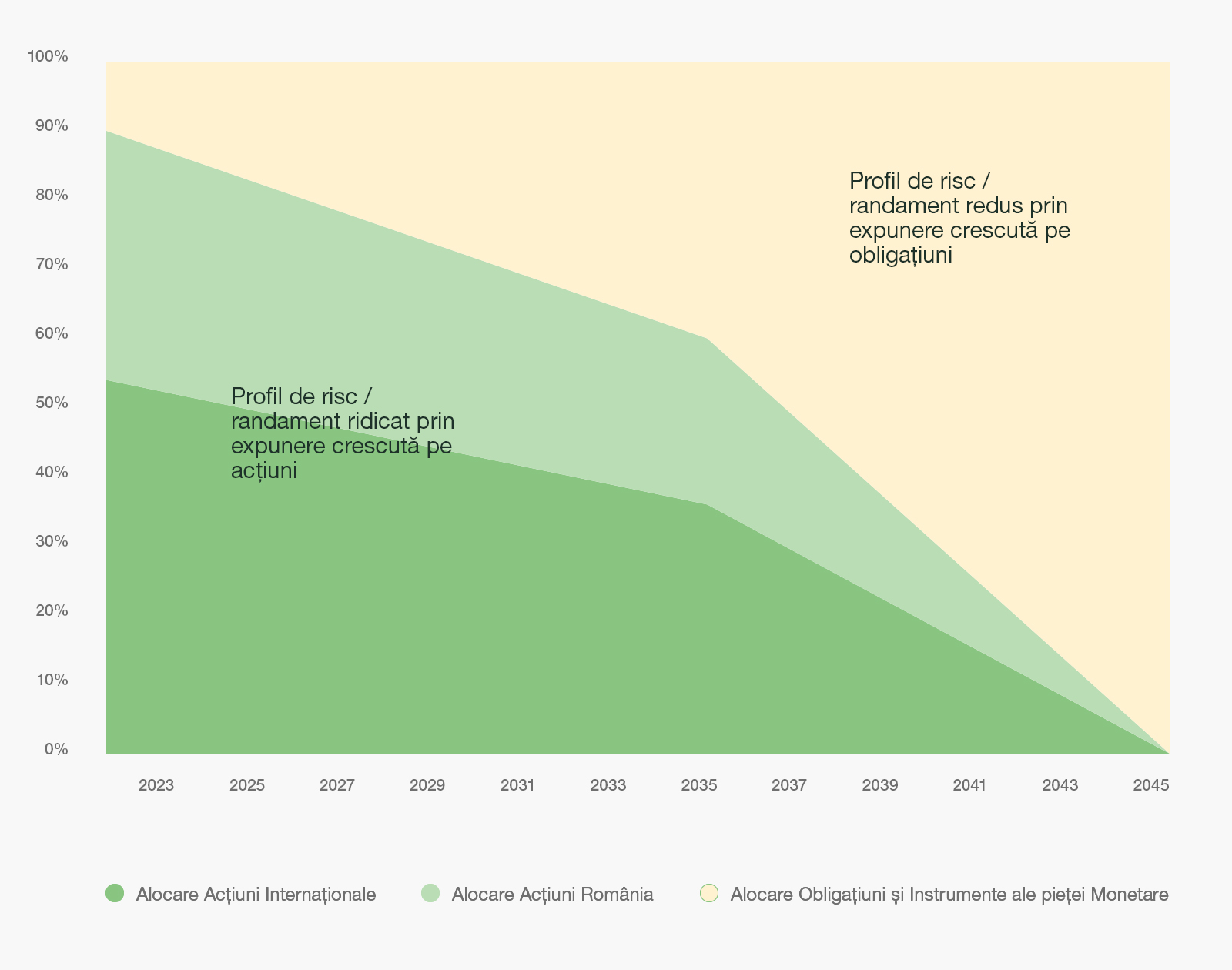

Open-end investment fund with a predetermined time horizon (2045) and dynamic asset allocation. The fund will have a higher risk / return profile in the first years of investment, when the investment horizon is far away, thus offering investors the opportunity to have increased exposure to shares. As the time horizon to the target date decreases, the Fund will increase its allocation to low risk / return assets, such as bonds and money market instruments, to reduce risk and increase predictability.

The objective of the fund is to obtain favorable long-term returns, as well as to gradually limit the volatility of the portfolio in order to preserve the value as the Fund approaches the target date.

Through the investments made, the fund aims to provide customers with high liquidity and diversification.

The performance of the Fund may be influenced by the negative performance of one or more financial markets in which the Fund invests. In this sense, there is no form of guarantee for the investments made by investors.

Who do they suit?

The reasons why you can choose a fund with a predetermined time horizon are many, whether you are thinking about children's education, a new home, a pension or simply investing for "black days" these funds can help you implement a simple and automatic strategy. for your purpose. It is important to select the best time horizon for your goal.

With a diverse mix of stocks and fixed-income instruments that rebalance over time, funds with a predetermined time horizon are designed to make investing easier for your goal. And because diversification is another important pillar when making an investment, it is good to know that equity investments will be made in several markets: about 60% of investments will be with international exposure, while about 40% of investments will be be to the Romanian stock market.

We offer you a fund with a predetermined time horizon that can be bought in both RON and EUR: BRD Horizon 2045.

In the following chart you can find a summary of its strategic allocation that changes depending on the number of years until the predetermined date of his.

ISIN Fond Class RON: ROAAWR6PTQ41

ISIN Fond Class EUR: ROC6U6UG9PZ5

Decizie autorizare ASF: 66/28.04.2022

Registru ASF: CSC06FDIR/400124/28.04.2022

GIIN: YCEN9M.00011.SF.642/ 02.05.2022

LEI: 787200JPZXZZP3TCKQ22

Urmărește evoluția Class RON pe Bloomberg*

Urmărește evoluția Class EUR pe Bloomberg*

* Informațiile sunt prelucrate și puse la dispoziție de entitatea-terță Bloomberg, iar BRD Asset Management S.A.I. S.A. nu iși asumă nicio responsabilitate cu privire la conținutul informațiilor furnizate de Bloomberg.

Informațiile și datele prezentate au rolul de a permite clienților și potențialilor clienți ai BRD Asset Management S.A.I. S.A. să ia o decizie de investiții informată. Prin consultarea acestui material, sunteti de acord sa accesați și utilizați aceste date exclusiv în scop investițional.

mediu spre scăzut (Class EUR)