Sustainability Information

Product name: Open-End Investment Fund BRD Orizont 2035

Classification under EU Regulation No. 2088/2019: Article 8

LEI: 787200940FJFPO6V6D08

Version 1

Date: 13.10.2025

Information regarding the Open-End Investment Fund BRD Orizont 2035

which promotes environmental and social characteristics

a) Summary

The Open-End Investment Fund BRD Orizont 2035 (FDI BRD Orizont 2035) is a financial product with a predetermined time horizon (year 2035) with local and global exposure. The investment fund promotes environmental and social characteristics by building a diversified portfolio through allocating resources in financial instruments (shares, bonds, money market instruments) that have improved environmental, social, and governance (ESG) characteristics at the aggregate portfolio level; however, the fund does not have a sustainable investment objective nor does it aim to have a minimum proportion of sustainable investments. The fund will invest at least 75% in financial instruments aligned with environmental and social characteristics. To support investment decisions, ESG analysis will complement the established evaluation of financial information. For selecting financial instruments (shares, bonds, UCITS traded as ETFs, and money market instruments), the Fund will use specific ESG methods, such as “positive screening” and “negative screening” and the use of ESG scores from a recognized external data provider (Morningstar - Sustainalytics) to build a portfolio with improved environmental, social, and governance characteristics, aiming to contribute to reducing environmental and social risks.

(b) No Sustainable Investment Objective This financial product promotes environmental or social characteristics but does not have sustainable investments as its objective nor aims to have a minimum proportion of sustainable investments.

(c) Environmental or Social Characteristics of the Financial Product The Open-End Investment Fund BRD Orizont 2035 aims to contribute to reducing environmental and social risks by building a diversified portfolio with improved environmental, social, and governance (ESG) characteristics at the aggregate portfolio level. The fund will invest at least 75% in financial instruments aligned with environmental and social characteristics. To promote environmental and social characteristics by building a portfolio with improved ESG characteristics, the fund will use specific ESG methods:

- Use ESG scores from a reputable external data provider (Morningstar - Sustainalytics).

- Positive screening or exclusionary screening. In cases of investments in financial instruments with similar characteristics (such as industry, sector or geographical exposure, type, liquidity, costs, etc.), the fund will select instruments with superior ESG scores. The fund will not invest in financial instruments with an ESG score above 50 according to Morningstar – Sustainalytics;

- Monitoring the overall ESG risk of the fund and limiting it by maintaining an aggregate average score of financial instruments with improved environmental and social characteristics (equities, bonds, ETFs, and money market instruments) of maximum 25. If the aggregate average score of these instruments exceeds 25, the fund portfolio will be rebalanced within a reasonable timeframe and respecting investors’ interests.

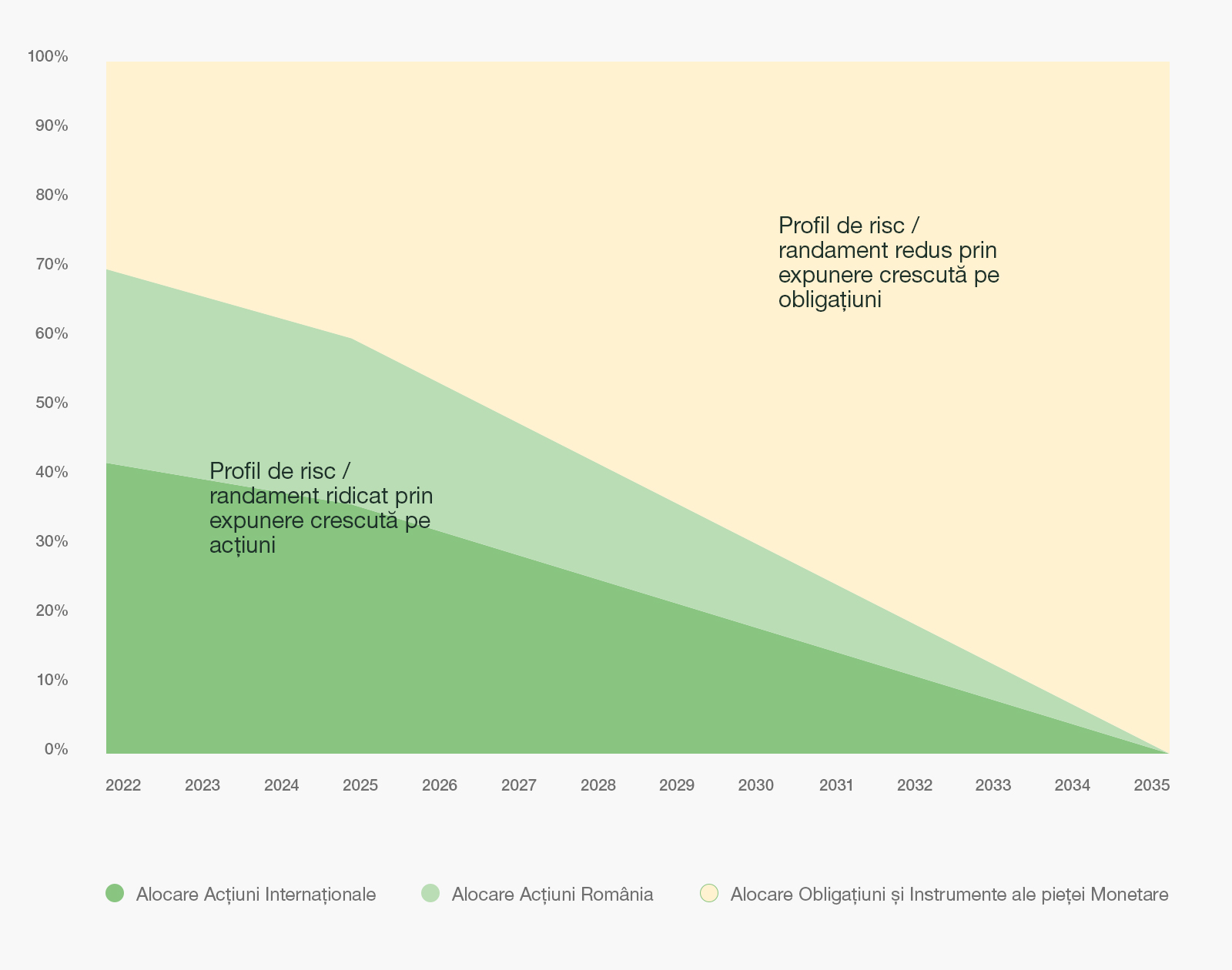

(d) Investment Strategy The Open-End Investment Fund BRD Orizont 2035 is a financial product with a predetermined time horizon (year 2035) with local and global exposure. The Fund’s investment policy aims to achieve favorable long-term returns in accordance with a gradual shift in allocation across main asset classes as well as a gradual reduction of portfolio volatility to preserve value as the Fund approaches the target date (year 2035). Asset allocation is dynamic and adjusts as the Fund approaches the target date. Thus, the Fund will have a higher risk/return profile in the early years of investment, when the investment horizon is distant, offering investors the possibility to have exposure to shares from Romania, the EU, and third countries. As the time horizon to the target date shortens, the Fund will increase allocation to assets with a lower risk/return profile, such as bonds and money market instruments, to reduce risk as the Fund approaches the target date. To support investment decisions, ESG analysis will complement the established evaluation of financial information. For selecting financial instruments (shares, bonds, UCITS, and money market instruments), positive and exclusionary screening will be used to build a portfolio with improved ESG characteristics, aiming to reduce ESG risks.

To evaluate good governance practices of invested companies, including solid management structures, employee relations, staff remuneration, and tax compliance, FDI BRD Orizont 2035 uses an internal methodology based on the Governance (G) component of ESG ratings from Morningstar - Sustainalytics, Bloomberg data, Societe Generale’s sector policies, and company reports. Sustainalytics’ governance analysis considers company structures, practices, behaviors, and their ability to create long-term value for shareholders and stakeholders transparently. Specifically, it considers management quality and integrity, governance structures, ownership and shareholder rights, remuneration, audit and financial reporting, and stakeholder relations. Bloomberg’s governance evaluation is based on management structure, personnel issues, remuneration policy, and quality of financial reporting. In case of ETFs, FDI BRD Orizont 2035 will invest only in ETFs that qualify as financial products under Articles 8 and 9 of EU Regulation 2019/2088, which are required to assess the good governance of the companies they invest in. If a breach of these criteria is found after acquisition, the respective financial instrument will be sold, ensuring protection of unit holders’ interests.

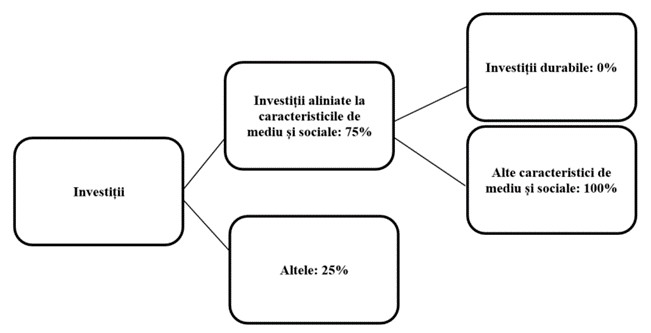

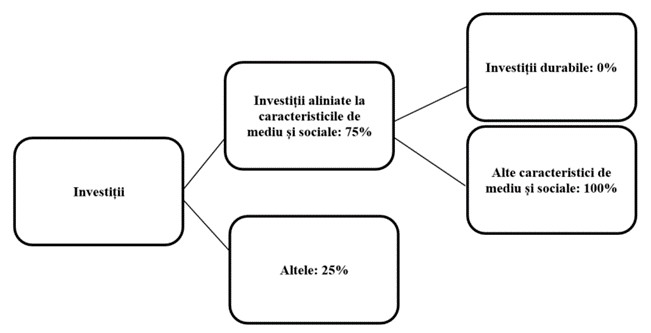

(e) Proportion of investments Asset allocation is dynamic and adjusts as the Fund approaches the target date. Thus, the Fund will have a higher risk/return profile in the early years of investment, when the investment horizon is distant, offering investors the possibility to have exposure to shares from Romania, the EU, and third countries. As the time horizon to the target date shortens, the Fund will increase allocation to assets with a lower risk/return profile, such as bonds and money market instruments, to reduce risk as the Fund approaches the target date.

The Fund will always maintain 75% of its assets in “Investments aligned with environmental and social characteristics” (“Other environmental and social characteristics”). This category may include shares, bonds, UCITS traded as ETFs, and money market instruments. The “Other” category, representing a maximum of 25% of totalFund assets, may include financial instruments without an ESG score such as cash, shares, bonds, UCITS traded as ETFs, money market instruments, or other financial instruments permitted by law.

(f) Monitoring Environmental and Social Characteristics To monitor compliance with environmental and social characteristics, the weighted average ESG rating of FDI BRD Orizont 2035 holdings (equities, bonds, ETFs, and money market instruments) classified in the portfolio section with improved environmental and social characteristics (minimum 75% of total assets) must not exceed 25. The aggregate average score of financial instruments with improved environmental and social characteristics is continuously monitored, and if it rises above 25, the fund portfolio will be rebalanced within a reasonable timeframe and respecting investors’ interests. The fund will not be exposed to financial instruments with an ESG score above 50 according to Sustainalytics. Also, the fund will hold at any time financial instruments from a maximum of 5 issuers with an ESG score above 30. ESG scores of financial instruments are verified before investment and periodically during holding.

(g) Methodologies for Environmental or Social Characteristics Measurement of how the social and environmental characteristics promoted by FDI BRD Orizont 2035 are met is based on ESG scores provided by a third-party provider, Morningstar, which provides Sustainalytics ESG ratings. Sustainalytics’ ESG risk ratings measure a company’s exposure to industry-specific intrinsic ESG risks and how well the company manages these risks. This multi-dimensional ESG risk measurement combines management and exposure concepts to provide an absolute ESG risk assessment. Sustainalytics identifies five categories of ESG risk severity that may affect a company's rating.

| Negligible | Low | Medium | High | Severe |

| 0-10 | 10-20 | 20-30 | 30-40 | 40+ |

ESG Risk Rating Scale:

Sustainalytics’ ESG risk rating methodology[1] includes:

Total exposure: Initially determines exposure to each material ESG sector.

Manageable risk: Analyzes what part of company risk can be effectively managed through ESG programs and policies.

Unmanageable risk: Some risks are considered unmanageable. For example, an oil company cannot fully eliminate carbon emissions risks, so these are excluded.

Managed risk: For manageable risk, company’s performance is reflected in its policies, programs, practices, and quantitative performance measures.

Management gap: Reflects unmanaged risk. Controversies reduce management score as they show deficiencies in company programs and policies.

Unmanaged risk: Overall ESG risk is calculated by adding unmanaged risk values for each significant ESG aspect.

[1] Details regarding the methodology used by Sustainalytics can be found here: https://www.sustainalytics.com/esg-data

(h) Data Sources and Data Processing FDI BRD Orizont 2035 uses ESG scores from a third-party provider (Morningstar, providing Sustainalytics ratings) to build a portfolio with improved ESG characteristics. The Sustainalytics methodology is described above. Additionally, BRD Asset Management S.A.I. S.A. uses an internal methodology based on the Governance (G) component of Sustainalytics ESG ratings, Bloomberg data, Societe Generale sector policies, and company reports to assess good governance.

Data quality is ensured by using reputable sources (ESG scores calculated by Sustainalytics are taken from Morningstar or the Bucharest Stock Exchange). ESG scores provided by Morningstar, Bloomberg governance data, Societe Generale sector policies, and company reports are periodically verified for updates and monitoring.

ESG evaluations used for monitoring ESG characteristics and risks of the fund are obtained via a platform provided by Morningstar or the BVB. Based on Sustainalytics ESG ratings, the weighted average ESG score of financial instruments with improved environmental and social characteristics (equities, bonds, UCITS, and money market instruments) representing at least 75% of total fund assets is calculated. The effective exposure of these instruments in the portfolio is rescaled to 100%. The weighted average score is calculated as the weighted arithmetic mean of the holdings' scores in the portfolio section with improved environmental and social characteristics. The management company does not estimate ESG ratings.

(i) Methodology and Data Limitations Since ESG is a relatively new field, ESG analysis inherently presents challenges: company-level data may be incomplete, unstandardized, inaccurate, or temporarily unavailable; different rating providers use different methodologies, leading to varying ESG risk assessments.

ESG scores are updated periodically but may lag in reflecting risks due to complexity.

These limitations are inherent to the ESG domain due to the complexity of covered risks and the relatively recent integration of ESG in investment processes. FDI BRD Orizont 2035 promotes environmental and social characteristics generally, intending to contribute to reducing sustainability risks. Given the fund’s diversification and use of a reputable ESG rating provider covering a wide range of ESG aspects with periodic updates, these limitations should not significantly affect the fund’s ability to meet environmental and social characteristics.

(j) Due Diligence Obligation BRD Asset Management S.A.I. S.A. has implemented internal governance controls to ensure obligations are met. Holdings classified in the portfolio section with improved environmental and social characteristics (minimum 75% of total assets) are periodically reviewed to limit the fund’s ESG risks by verifying: (i) ESG scores of financial instruments with improved environmental and social characteristics (equities, bonds, ETFs, and money market instruments) do not exceed 50 according to Sustainalytics; otherwise, the non-compliant instrument will be divested within a reasonable timeframe respecting investors’ interests; (ii) maintaining a maximum of 5 issuers with ESG scores above 30, otherwise divesting one of these instruments within a reasonable timeframe respecting investors’ interests; (iii) aggregate average ESG score of instruments with improved environmental and social characteristics does not exceed 25; otherwise, the fund portfolio will be rebalanced within a reasonable timeframe respecting investors’ interests. The company includes procedures dedicated to assessing relevant financial and sustainability risks in its processes.

(k) Engagement Policies For FDI BRD Orizont 2035, engagement is not part of the environmental or social investment strategy. However, the fund will support initiatives that contribute to improving environmental, social, or governance characteristics of issuers in which it invests. The fund will vote against initiatives that could increase environmental, social, or governance risks of issuers and against initiatives contradicting internationally recognized ESG principles (e.g., United Nations Global Compact).

(l) Designated Reference Benchmark FDI BRD Orizont 2035 does not have a specific index designated as a reference benchmark to determine whether the financial product is aligned with environmental and/or social characteristics.

(m) Information pursuant to Article 8 of EU Regulation 2019/2088 (SFDR) Information on how the fund promotes environmental or social characteristics is included in the Annex of the FDI BRD Orizont 2035 Issuance Prospectus.

(n) Information pursuant to Article 11 of EU Regulation 2019/2088 (SFDR) Information on how environmental or social characteristics have been met and on the overall sustainability impact of FDI BRD Orizont 2035 can be found in the fund’s annual report.